Church is one of the beautiful places to worship and get close to the creator. Imagine walking past a grand, historic church nestled in the heart of your city. It’s a great pleasure for a religious person who usually goes there.

However, ignoring all of these, in the United States, you may see people whispering, “Does churches pay property taxes?” In general, the answer is “NO.” Now, you may ask, “What’s hidden inside this hot topic?”

Well, you have to go through a complex mix of history, law, and tradition to reach the answer. Indeed, it’s still a controversial question that often sparks curiosity and debate. But no worries! We are here to solve the mystery and explain the reasons behind church property tax exemption.

Property taxes are levied by local governments on real estate, including land and buildings. Taxes are essential revenue sources for cities, counties, and other municipalities, which help to fund community platforms. These community essentials include education, road maintenance, emergency services, and communication services.

Property taxes are usually calculated based on the assessed value of the property and the local tax rate (also known as the mill rate). The basic formula is:

Property Tax = Assessed Value × Tax Rate

For example, if the value of a house is $300,000 and the local tax rate is 1.5%, the annual property tax would be:

300,000 × 0.015 = 4,500

Property taxes are crucial for a country's economy. They help in maintaining public services and infrastructure throughout the country. Without property taxes, local and state governments would struggle to cover these costs. Which eventually affects the basic amenities and public safety measures.

However, there are a few sectors which are exempt from paying property taxes. Churches and religious institutions are especially excluded from paying taxes. Though there are a lot of debates going on regarding this exemption issue, still under U.S. tax law, they don’t need to pay property taxes.

Churches and other religious institutions are normally exempt from paying property taxes in the United States. It's not only about law but also about historical tradition and cultural priorities. Indeed, the IRS (Internal Revenue Service) classifies churches as 501(c)(3) entities that ensure automatic exemption from federal income taxes. Also, in most jurisdictions, churches don't need to pay local property taxes either.

Importantly, these tax exemptions follow the paths of the First Amendment, which ensures religious freedom. The First Amendment also draws a separation line between religious institutions like church and state. It guarantees religious institutions are out of government sight, and they can’t interfere with religious practices.

However, there are other valuable reasons behind the question, “Why do churches pay no taxes?” A 2016 study, “The Socio-economic Contributions of Religion to American Society: An Empirical Analysis,” estimated that religious organizations contribute nearly $1.2 trillion annually to the U.S. economy.

These religious institutions conduct many community welfare programs for the homeless and uprooted people. There are programs, including soup kitchens, homeless shelters, free counseling, and youth programs. Indirectly, these activities save local governments a lot of money. This amount is more than the national economic value of most of the countries worldwide.

However, in a few cases, churches pay taxes, too. Tax exemption typically applies on properties used directly for worship or ministry. For instance, think of sanctuaries, parsonages, prayer halls, etc. If a church proceeds to earn money from commercial territory, such as leasing land for profit, it has become taxable. Indeed, there are still debates going on about tax exemptions for nonprofits.

In the United States, churches rarely pay property taxes. More specifically, in most cases, churches never really pay taxes. The U.S. law and tradition both work behind these exemptions. Still the question is, “Do churches pay property taxes?” Sometimes, in specific circumstances, churches must pay taxes.

The rule for churches is that they don’t need to submit their tax file for religious purposes, such as sanctuaries, chapels, or parsonages. This exemption was granted under their 501(c)(3) status and upheld by state laws in 49 out of 50 states (per the National Conference of State Legislatures). So, churches stay outside of tax assessment at the end of the year.

However, if churches own any non-religious property or perform profit-making activities, that will be counted as taxable income. These activities can be house rental, parking lot leased, book store, etc. In this kind of scenario, churches will pay tax annually like other tax-giving entities. So, it's evident that churches actually never pay their taxes until an exceptional situation arrives.

Church tax exemptions carry a significant financial impact on local governments and communities. Religious institutions benefit from tax exemptions, while municipalities are getting concerned about revenue shortfalls. It ultimately affects public service and infrastructure, sparking debates around the state. People are talking across various communities about equity in tax exemption.

Revenue loss has become a headache for local governments in the USA. According to the Secular Humanism Society, the U.S. loses approximately $71 billion annually due to property tax exemptions for religious institutions. This amount includes property taxes, income taxes, and investment taxes that churches do not pay. This report also shows how churches contribute the least amount of their earnings to charitable work.

Moreover, cities with heavy populations and high property values struggle the most from tax exemptions. Cities like New York City, Los Angeles, and Chicago are immensely affected. For instance, churches in New York City own real estate property worth billions of dollars. As a result of tax exemption, the local governments lost tens of mission dollars from revenue.

Another statewide report conducted in 2021 by the state Office of Policy and Management shows that 51% of its property was tax-exempt in Hartford, Connecticut city. Most of the percentage came from churches and non-profits. The same thing happened with Lakewood Church in Texas. Lakewood Church holds a sum of $70 million in property. If they were taxed at commercial rates, the state could generate over $1 million in revenue yearly.

While churches are normally excluded from paying taxes, they still make notable financial and social contributions to communities. These steps help the local governments in easing burdens and portray social bondings.

Managing a church is not only about playing spiritual roles but also working for society. Many congregations are making contributions to the economy through charitable services, volunteer efforts, and job creation. As we mentioned earlier, an analysis found that religious organizations contribute nearly $1.2 trillion annually to the U.S. economy.

However, most of the churches arrange food pantries and soup kitchens and offer free meals if needed. For instance, St. Mary’s Church in Chicago serves over 1,000 meals per week for homeless people and low-income families.

Financially healthy churches help with their emergency funds by providing rent, utilities, or medical expenses. They also arrange scholarships for students who come from low-income backgrounds.

What’s more, volunteering is another good thing where non-profit organizations have done a great job. According to a particular study, it’s evident that religious organizations donate 2.5 billion volunteer hours annually. If the government had to pay these volunteers, it would be equivalent to billions in labor costs.

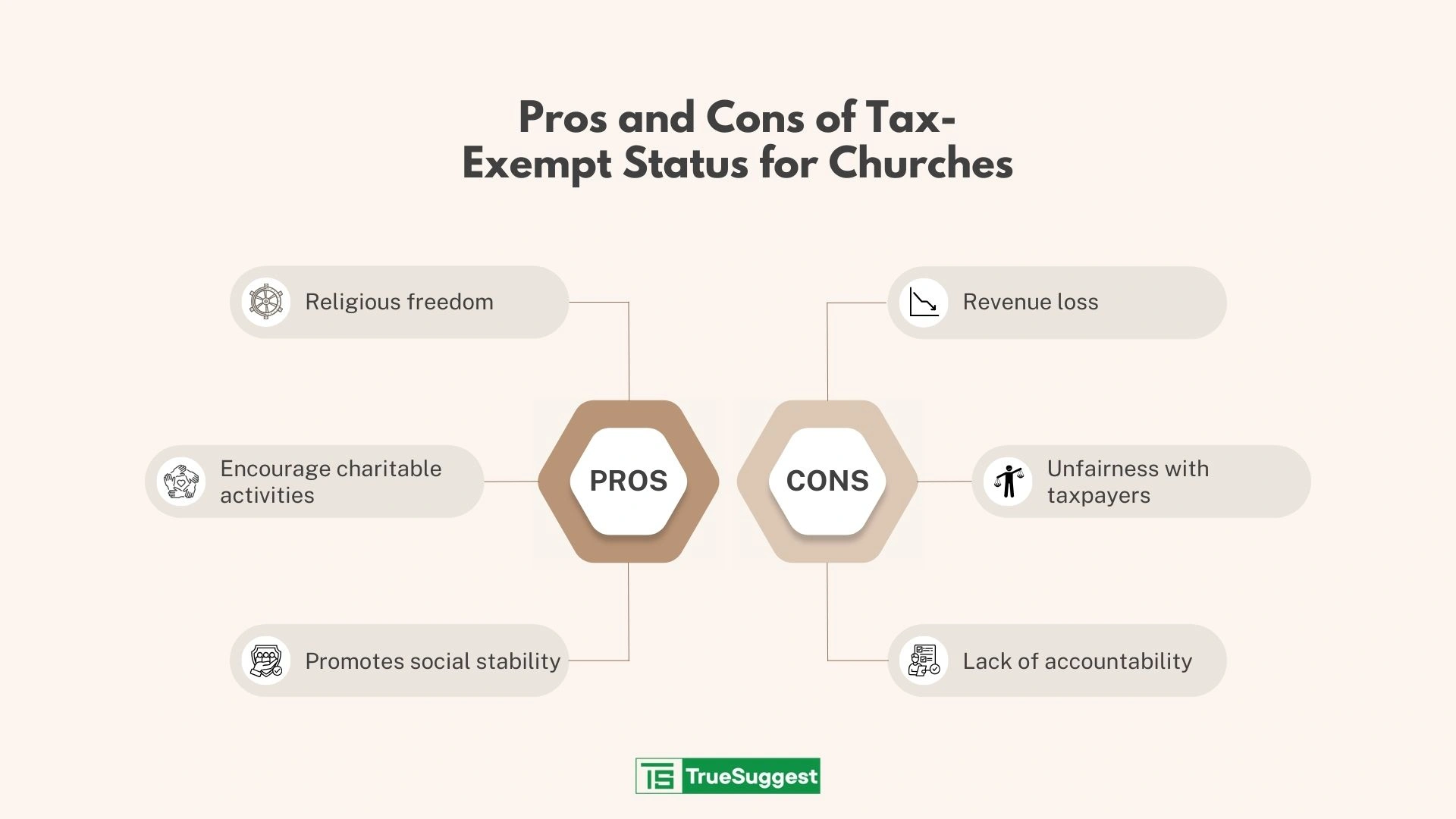

Tax exemption for nonprofits is one of the most controversial things in the history of the U.S. It helps the state and society in various ways, which is undeniable. At the same time, critics are arguing that the government is losing revenue on that. But what does it look like from a neutral point of view? What are the pros and cons of having a 501(c)(3) status? Let’s discuss them one by one—

Preserves Religious Freedom: Following the implementation of the First Amendment’s separation of church and state, it created an opportunity to practice religion with freedom. Taxing religious institutions counted as government interference in spiritual practices.

Encourages Charitable and Community Activities: Churches often use their funds for charity work, community outreach, and social services. They are working on volunteering programs and job creation. Local food banks and shelters run by churches help reduce homelessness and hunger. They are able to convert the tax-exempted amount as helping funds.

Promotes Social Stability: Churches are very popular and effective places for social support, such as counseling, mental health support, and crisis intervention. These are very practical steps to build a strong community. Besides, they strengthen community bondings and lower crime rates and drug addictions.

Revenue Loss for Local Governments: Losing revenue is a burning concern for the governments, as well as for critics. Local and state governments are losing a vast amount of revenue due to tax exemptions in non-profits. In the eyes of many analysts, municipalities lose funding for public services, schools, and infrastructure due to non-taxable church properties.

Unfair Burden on Taxpayers: Local governments need to increase taxes on residential and commercial properties to recover the loss counts from religious organizations. Tax-payers are becoming irritated carrying this burden. However, these tax-exempt organizations also contribute a lot to society. They are also reducing the government's burden with volunteering and charity programs.

Lack of Accountability: Therefore, churches are excluded from paying taxes, and they don’t need to disclose financial statements or report income to the IRS. This may lead to financial misuse or unethical practices.

However, it’s very unlikely to happen as most of the churches have a church treasurer to look after. His duties and responsibilities are fixed to keep the church finances transparent and maintain accountability.

Handling the church and religious organization's taxes varies around the world. It reflects the particular nation’s historical, cultural, and legal approaches to religion and state finances.

In the U.S., non-profit organizations are totally exempt from paying taxes. While some countries offer full tax exemptions, others charge taxes directly on religious institutions and their members. If you still have questions like “Does churches pay property taxes” let’s have an overview of tax handling in a few particular countries.

France is another country where religious institutions stay away from paying taxes. It’s one of the countries that has a strict policy on secularism (laïcité). In France, churches built before 1905 are state-owned and maintained as national heritage sites. However, religious institutions need to rely on donations and private funds to continue their operations.

Church tax in Germany is known as Kirchensteuer. Members of Catholic, Protestant, or Jewish communities pay 8-9% of their income as church tax (Kirchensteuer). In Bavaria and Baden-Württemberg, church members are charged 9% of their income tax, while in the rest of Germany, it’s 8%. This amount is collected by the state and transferred to the churches.

In Sweden, they recognize church tax as Kyrkoavgift. Church tax is optional for the citizens in this country. Anyone can formally leave the Church of Sweden to avoid paying the fee. This fee usually is 1-2% of their income tax. The tax collection and transfer system in Sweden is the same as that in Germany. The Swedish Tax Agency collects the tax and passes it to the respective church. In addition, a survey found that 68% of Swedes paid their tax in 2017.

Most of the religious communities in Italy are Catholic. Taxpayers provide 0.8% of their income tax to religious institutions as Otto per Mille. They have the flexibility to choose whether they want to support the Catholic Church, Protestant churches, Jewish communities, or the state itself. These funds are used for charity, cultural preservation, and religious activities.

Canada follows the same tax laws and regulations for churches and nonprofits. Religious institutions are totally exempt from paying taxes in this country. To be eligible for tax exemption, they must register as charitable organizations. However, only those charities that have existed since at least December 31, 1977, will be able to take the benefits as non-profits.

The question of religious institutions or churches paying taxes is complicated and controversial at the same time. Tax exemption laws and regulations and tax rates vary depending on a particular country's policy. While the U.S. and Canada exempted nonprofits and religious institutions from giving tax, other countries chose different paths. For example, Germany and Sweden receive tax from community members at a specific percentage.

However, many argue that the exemption of taxes for churches affects the state's economy. On the contrary, they are doing a lot of good work, such as volunteering, arranging charity programs or social services, and releasing burdens of government. After all, what’s important is that legal and economic aspects are not the only things to be considered. Cultural and social implications have a hidden priority, which is essential and should carry on.

Ans: There's another question to ask first when selling the church's property. Can a church sell its property, actually? Yes, the church can sell its property if it becomes a burden to the ministry. Although churches are usually tax-exempt properties, right after selling the property to a non-exempt entity, the tax-exempt status got revoked. These non-exempt entities can be private businesses or individuals.

Ans: Political activities and church tax exemptions are standing face to face. Churches in the United States are usually excluded from paying taxes on their income, which is under section 501(c)(3). However, can churches lose tax-exempt status for that? Yes, engaging in political activities contradicts this status. In some cases, this status may revoked.

There’s a legal framework named The Johnson Amendment that took place in 1954. According to this framework, religious institutions and non-profits, including churches, are prohibited from taking part in any political campaigns. They can’t even support any political candidates.

Ans: Church property tax is an unsettled discussion that has been going on for decades. While supporters of imposing taxes on churches have reasons and logic, tax-exemption supporters do the same. Some people want churches to pay property taxes as fairness to the taxpayers. They find this exemption status outdated and unfair.

Since the local governments are losing a huge amount of revenue due to 501(c)(3) status, it has become the most prominent argument. Property taxes are spent to fulfill essential community services such as schools, emergency services, and infrastructure. Excluding churches from taxation creates a gap here, which eventually becomes a hindrance to the improvement of public services.

Ans: The church finance committee is a crucial team that works to ensure compliance with the church tax laws, rules and regulations. Although the church is a tax-exempt entity, the finance committee still has responsibilities and roles to play to keep things right. To enjoy tax exemption status, the church has to update its paperwork on a regular basis and submit it to the IRS. The finance committee works on completing every necessary step to remain clean and accountable to the community.