Financial accounting is a special part of accounting that involves recording, summarizing, and reporting thousands of business transactions for a specific period. Managing finances is becoming more difficult in today’s fast-paced business environment. A financial accounting system helps any organization manage the accurate tracking, measurement, and communication of financial data. Businesses can maintain compliance and make informed decisions by understanding its basic elements. It ultimately helps to drive growth in a business.

In this blog, I will guide you in understanding what are the basic elements of a financial accounting system. I will also share the benefits of financial accounting systems and factors to consider before integrating one into a business. Whether you are a small business owner or a finance professional, learning these primary financial elements is essential for success.

Financial accounting is a special part of accounting that involves recording, summarizing and reporting thousands of transactions of a business.

A Financial Accounting System is a structured framework businesses use to record, process and report financial transactions. This system ensures that a company’s financial data is accurate, organized and compliant with regulatory standards such as GAAP or IFRS. A standard accounting system clearly defines a company’s financial health.

Some modern financial accounting systems examples are Quickbooks, Xero, Wave, Odoo, FreshBooks and Sage 50.

A financial accounting system provides many benefits to managing a company's finances. The business market is very competitive. An accounting system enhances operational efficiency and positions a company for growth and sustainability.

Here are the top benefits of using a Financial Accounting System:

A financial accounting system ensures methodical transactions for business. It creates a reliable financial trail. This accuracy helps businesses keep track of revenue, expenses, assets and liabilities. It also helps to maintain trust with stakeholders and regulatory bodies.

Financial accounting software helps users make data-driven decisions. You can create advanced financial reports for income, balance sheets, cash flow and more. Accurate financial insights help create effective budgets and make informed investment choices.

A financial accounting system helps to meet legal and regulatory requirements. Modern accounting systems will also help you to have smooth audits and prevent any penalties.

It is important to understand an organization's financial position for every stakeholder. An accounting system makes it easier to share financial reports with stakeholders. Concise reports help to build trust with investors, creditors and management.

A business has many repetitive data entry tasks. Modern accounting systems use advanced technologies like automation and artificial intelligence. Cloud-based accounting solutions increase business efficiency by offering real-time data access. Remote users can also access data and collaborate to manage the company's finances.

Accounting software helps to keep track of every business cost easily. It enables businesses to identify areas where resources can be used more efficiently and implement effective cost-control measures.

Real-time data access helps to respond to market changes live. The live updates of financial information help to grasp business opportunities and mitigate risks. A secure and updated accounting system also prevents fraud activity in the system.

A financial accounting system is vital for recording, organizing and communicating financial data for businesses and organizations. This system is designed to produce financial statements accurately while maintaining all business regulations. The statements used in financial accounting include five types of financial data: Assets, Revenues, Expenses, Liabilities and Equity.

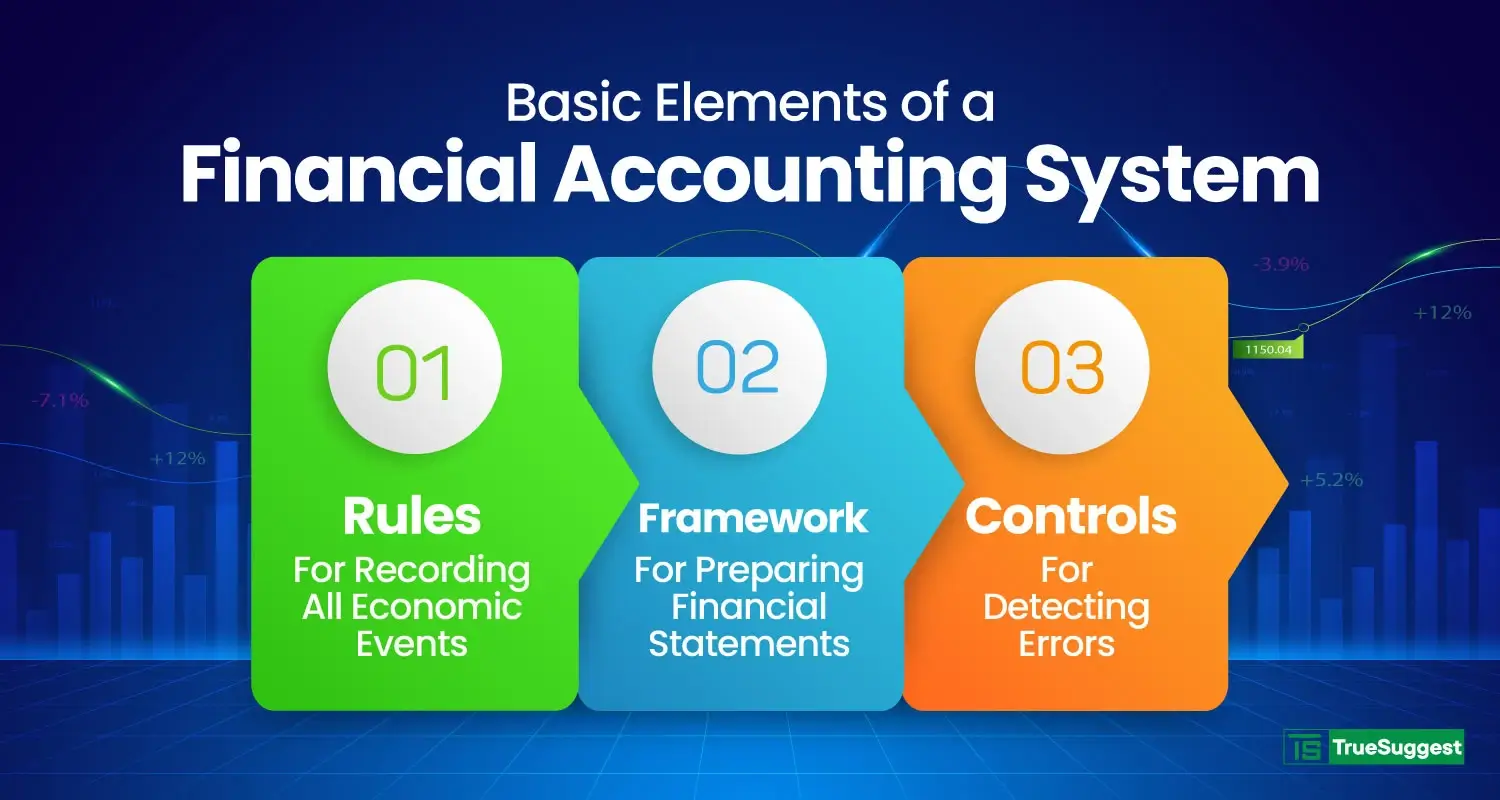

Three basic elements combine to create a user-friendly financial accounting system that serves the best economic management of a company. They are -

Rules: A transaction is the main event that affects the financial statement. One transaction may affect one, two or more items within the financial statement. The financial accounting system also determines what, when, and how transactions should be recorded and what amount should be recorded.

Framework: All transactions must be analyzed, recorded and summarized using an accounting framework. The counting formulas should be used to calculate and analyze all the data. The main accounting equation is expressed as assets, equal liabilities plus 'owners or shareholders' equity. This means that all assets are either financed by the money borrowed from external sources or the money invested by the company's shareholders.

Control: The accounting equation must balance. The final cash balance on the statement of cash flows must equal the ending cash balance on the balance sheet. The net income must match the net effects of revenues and expenses on retained earnings.

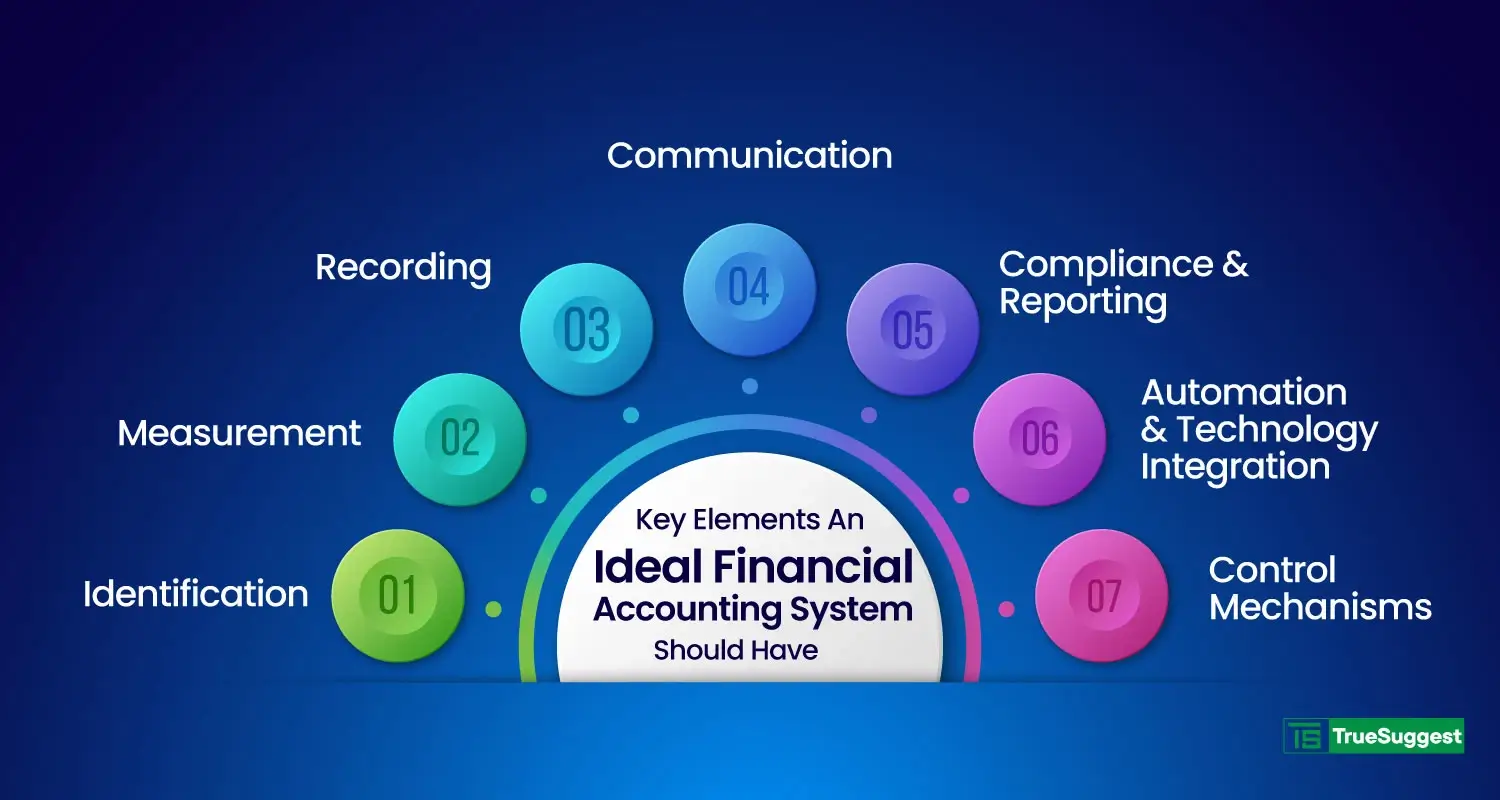

Before integrating financial accounting software into a business, we have to consider some key aspects of the software. Here are the key elements an ideal financial accounting software should have:

An ideal financial accounting system can identify and record a company's financial transactions. The system follows accounting standards like GAAP to record the data. The software can track the transactions and update the records according to that.

The ideal financial accounting software should quantify all transactions in monetary terms. The key metrics of measurement are revenue, costs, profits and losses. Standard measurement ensures uniformity and comparability across financial reports. The software should follow standard frameworks like IFRS and GAAP to guide these measurements.

Perfect financial accounting software should include all standard recording formats. Important documents like Journals, ledgers and trial balances should be presented in the standard format. The advanced recording feature helps maintain a detailed record of financial transactions.

Communication is a very important part of financial accounting. A perfect financial accounting software can deliver financial reports automatically. The common documents include income, balance and cash flow statements. Communication aims to provide insights into a company's financial health to investors, management and relative authorities.

The financial accounting solution follows regulatory frameworks like IFRS or US GAAP. For example, in 2024, new IFRS standards (such as IFRS 18 and 19) reshape disclosure requirements. So, to promote transparency and trust with stakeholders, the financial accounting system should be up to date with new compliance.

AI and cloud computing are broadly used in accounting systems. These help to enhance accuracy through automation. Cloud accounting solutions ensure real-time access and collaboration. In many developed countries, people use blockchain technology to ensure financial security and transparency.

The financial accounting system should follow policies and procedures to ensure accuracy and prevent fraud. It should also have automated audit transactions and ensure that each transaction can be traced back to its origin.

An all-in-one financial accounting system not only helps manage company operations but also helps make the best decisions for the business. Its basic elements help develop and manage any company's financial part. Businesses should use accounting systems to stay updated and compliant with changing regulations. I hope that after reading the blog you now have a clear idea what are the basic elements of a financial accounting system.

If you want to modernize your financial processes, integrate the financial accounting system that suits your business. Any scalable accounting solution will be better, as it is adaptive to your business circumstances. Nowadays, AI data analytics and blockchain are not just options but necessities. So, use advanced financial accounting software that is adaptive to the latest technology.