GST Calculator

What is GST?

GST in general means a tax on the consumption of almost all the goods and services. GST is applicable for all the businesses that annually exceed a certain amount, declared by the Govt.

There are two types of GSTs:

GST Inclusive

GST inclusive means total amount after including the GST in the original price. In easy terms, tax is not charged separately from the customer because it is already included in the price.

GST Exclusive

GST exclusive means tax is not included in the price. So it will be added separately.

How to Use TrueSuggests GST Calculator?

It's really easy to use TrueSuggests GST calculator. You need to follow some simple steps to calculate it.

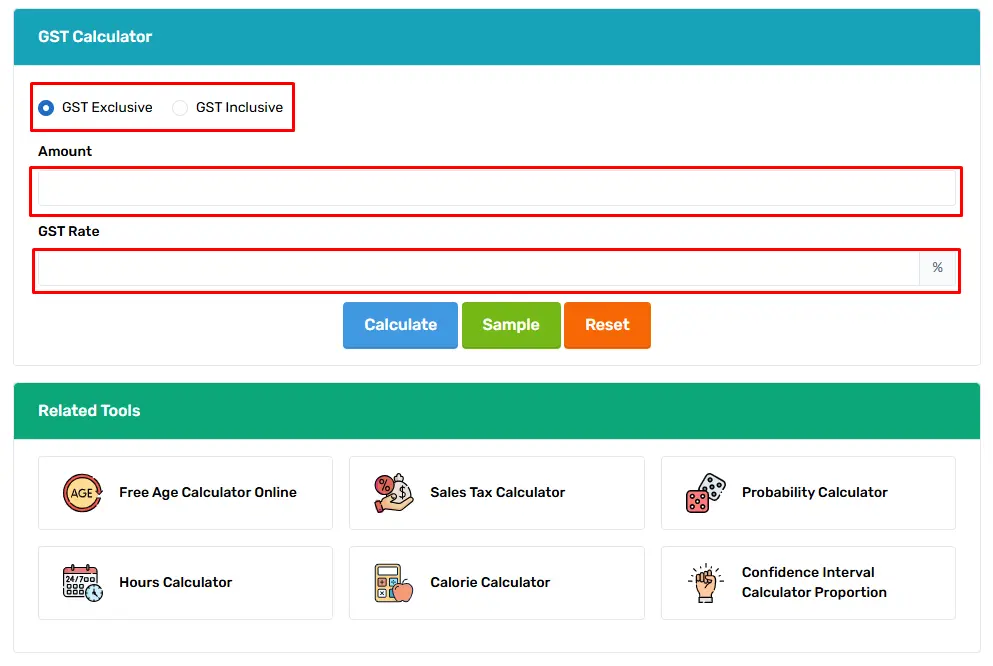

1. You will find two selection boxes and 2 radio boxes. You can calculate any GST, exclusive or inclusive you want from here.

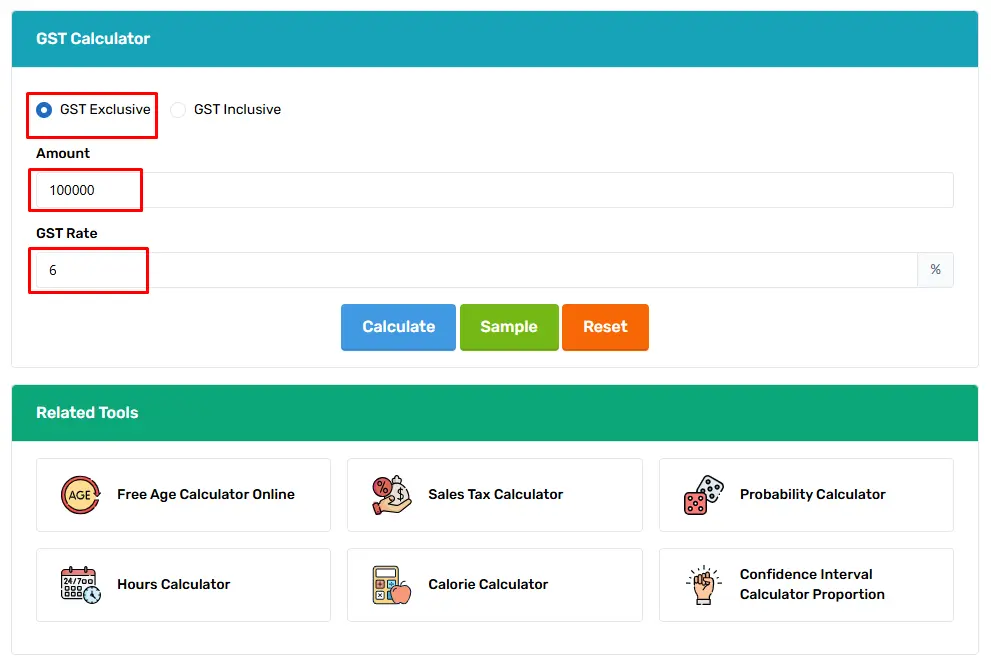

2. Here lets select GST exclusive. Then enter the amount and then the GST rate. I will put “100000” in the amount box and for the GST rate, I will use 6%.

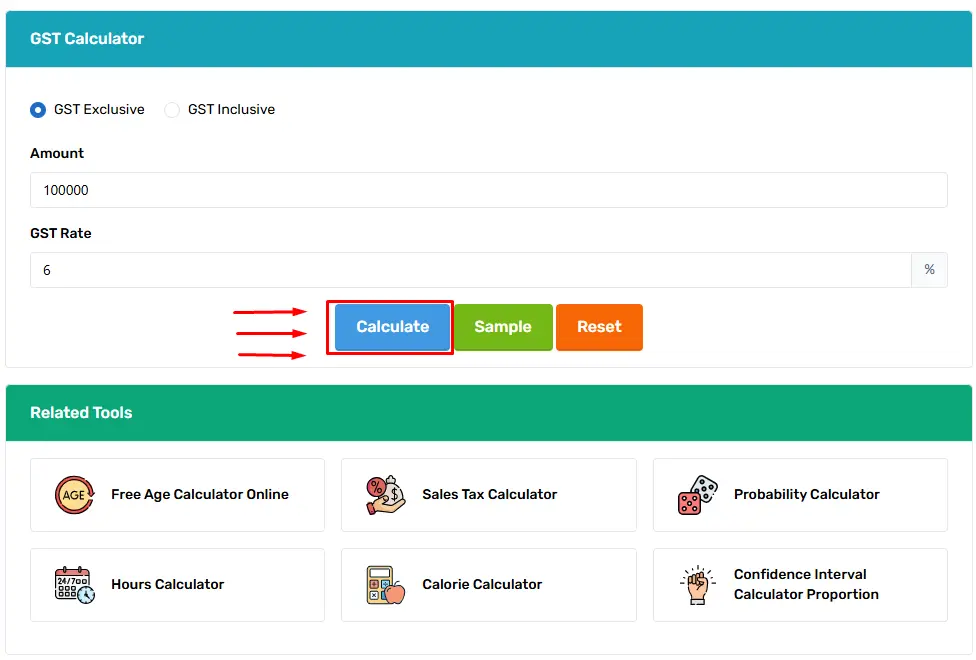

3. Then press the “Calculate” button.

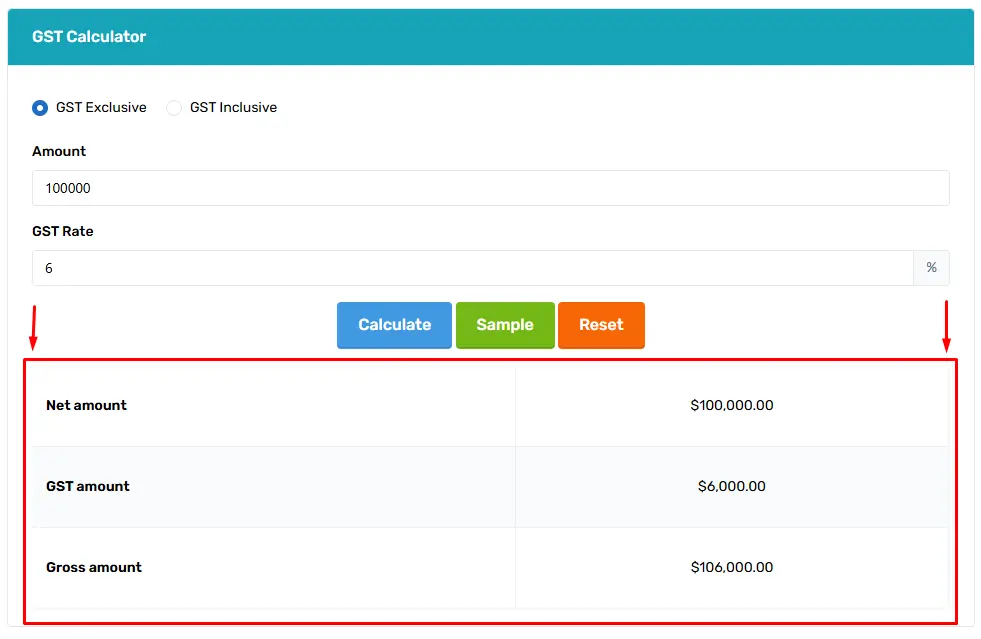

4. You will get a result like this.

How is GST Calculated?

GST is calculated with two easy mathematical formulas. As there are two types of GSTs, we need to use two different formulas to calculate them.

For GST Exclusive:

GST Amount = (Original Price × GST Rate) / 100

Final Price = Original Price + GST Amount

Let’s calculate these with with an example:

For exclusives let's say the product price is $1000 and GST rate is 18%. Then if we calculate it with the formula:

GST Amount = (1000 × 18) / 100 = $180

Final Price = $1000 + $180 = $1180

For GST Inclusive:

GST Amount = (Original Price × GST Rate) / (100 + GST Rate)

Base Price = Original Price − GST Amount

Let's take those same numbers.

GST Amount = (Amount × GST%) / (100 + GST%)

Base Price = Amount − GST Amount

GST Amount = (1000 × 18) / 118 = $152.54

Base Price = $1000 − $152.54 = $847.46

How Can a GST Calculator Help You?

Whether you are a businessman, accountant, buyer or seller you can use this GST calculator. As it does not give a probable answer, it gives an accurate answer, it can help you in saving time, solving any calculation accurately, reducing error, and help you both in inclusive and exclusive tax situations.

Limitations of Our GST Calculator

The only limitation our calculator has is it converts every data into dollars. So if you want to calculate data in your own currency then it is not possible. You cannot convert to other currencies.

Still our calculator is best because:

- It can calculate two types of GST; Inclusive and Exclusive.

- It can show 3 results in one go; net amount, GST amount and gross amount.

- Another great feature our calculator has is that it can teach you how to use it by showing you samples when you click the “Sample” button.

Frequently Asked Questions

Who Should Register for GST?

Business people, buyers, sellers, traders, manufactures who are doing more than the minimal turnover must register for GST. They also have to register a return file.

What are the Rates of GST in India?

As of 2025, there are mainly 4 types of slab rates according to BajajFinServ. They are 5%, 12%, 18%, and 28%. 0% tax eligible for items like milk, eggs. Educational services are eligible for 5%, 12%, 18%, and 28% depending on categories. 28% is applicable to goods like luxury items, high-end motorcycles and consumer durables.

How to Calculate GST for Freelancers?

Self-employed professionals or freelancers can easily calculate GST when their annual income exceeds approximately $24,000 USD. Firstly, you need to know if you are eligible or not. If yes, then you need to find your interest rate. After that, you need to calculate keeping in mind the inclusive or exclusive. Finally you can calculate using the above formula.

What is the Difference Between CGST, SGST, and IGST?

These are different types of GSTs. CGST is for central goods and services tax, SGST is for state goods and services, IGST is for integrated goods and service tax. There is another type of tax, that is UTGST, union territory goods and services tax.

.png)