Sales Tax Calculator

What is a Sales Tax?

A sales tax is a utilization tax on the retail sale of goods and services imposed by the government. Almost all countries of the world have applied different sorts of taxes to goods and services.

It is the additional amount that the government collects. Sales tax is entirely different from other types of tax, such as income tax or property tax.

However, sales tax is a certain percentage of the purchase cost added to the final cost of any product and service. The percentage or procedure of sales tax can vary according to the country's state laws.

What is Free Online Sales Tax Calculator

A free online sales tax calculator helps you find or calculate the tax amount you must pay based on your sales of products and goods. Anyone involved in business can use this calculator and benefit from it in business management.

Different states have different laws for providing sales tax. Calculating the exact amount of your sales tax could be much more difficult. In that case, an advanced sales tax calculator is a great option to solve the issue and accurately calculate your sales tax.

The user can find out the sales tax by just entering the total amount of their sales and the sales tax rate according to state laws. It is the easiest way to find the sales tax.

Sales Tax Calculation Formulas

Manual calculations for sales taxes can be time-consuming and may result in errors. So, using a free online tax calculator will be a wise decision. Once you understand the calculation process, you can easily find the tax amount using different tax rates.

We can express the tax calculation formula in different ways.

Here are the ways to express the calculation formula.

- ( Sales Tax Percentage / 100 ) * Price of Goods or Service

- ( Sales Tax = Purchase Price * Sales Tax Rate )

- ( Sales Tax Rate = Sales Tax Percent / 100 )

- ( Sales Tax = List Price * Sales Tax Rate )

How to Calculate Sales Tax

Sales tax is not applicable for every goods or services. It applies to certain products such as medicine, utilities, food, clothing, etc. However, the sales tax percentage can vary depending on the type, such as online or offline sales.

Let's understand how to calculate sales tax in detail.

The sales tax rate is shown in percentages, but it is better to convert it into decimal value in the manual calculation. It could be done by dividing the percentage rate by 100.

Working Process:

- First, find the list of prices and tax percentages.

- Divide the tax percentage by 100 to get the tax rate into decimal.

- Now, multiply the list price by the decimal tax rate to get the tax amount.

- Finally, add the tax amount to the list price to get the total price.

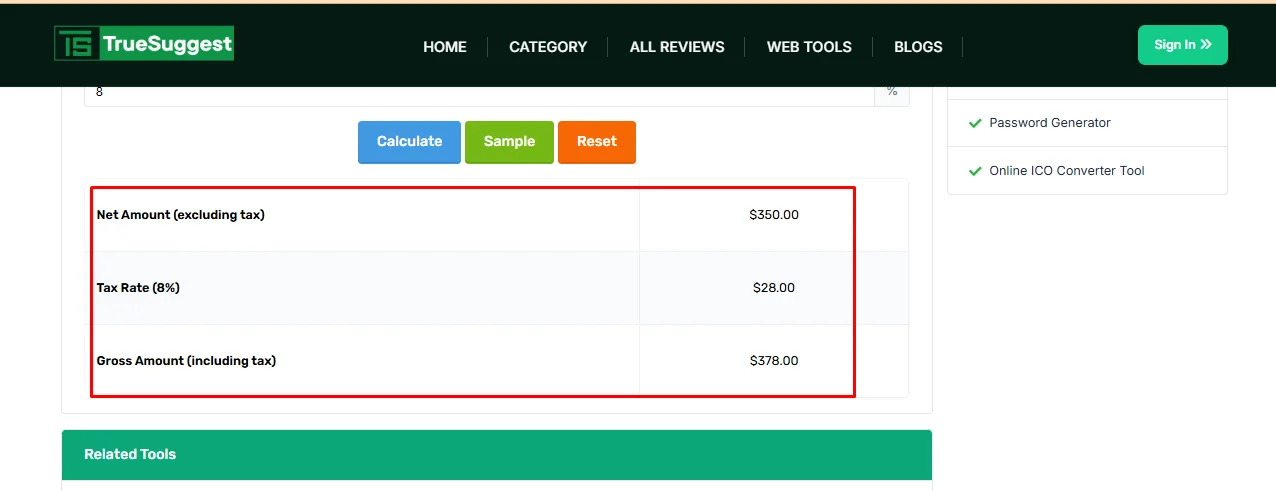

Suppose a product has a purchase price of $350, and the sales tax rate is 8%; then find the sales tax.

1: Here is the price is $350, and the tax percentage is 8%

2: Divide tax percentage by 100 to get the values into decimal: 8/100 = 0.08

3: Now, multiply the list price by the tax rate: 350 * 0.08 = 28

So, the owner must pay $28 as a tax while purchasing $350 products.

How to Use Sales Tax Calculator

Here is a user guide on how to use a free online sales tax calculator.

Step1: At first, you have to visit our website:

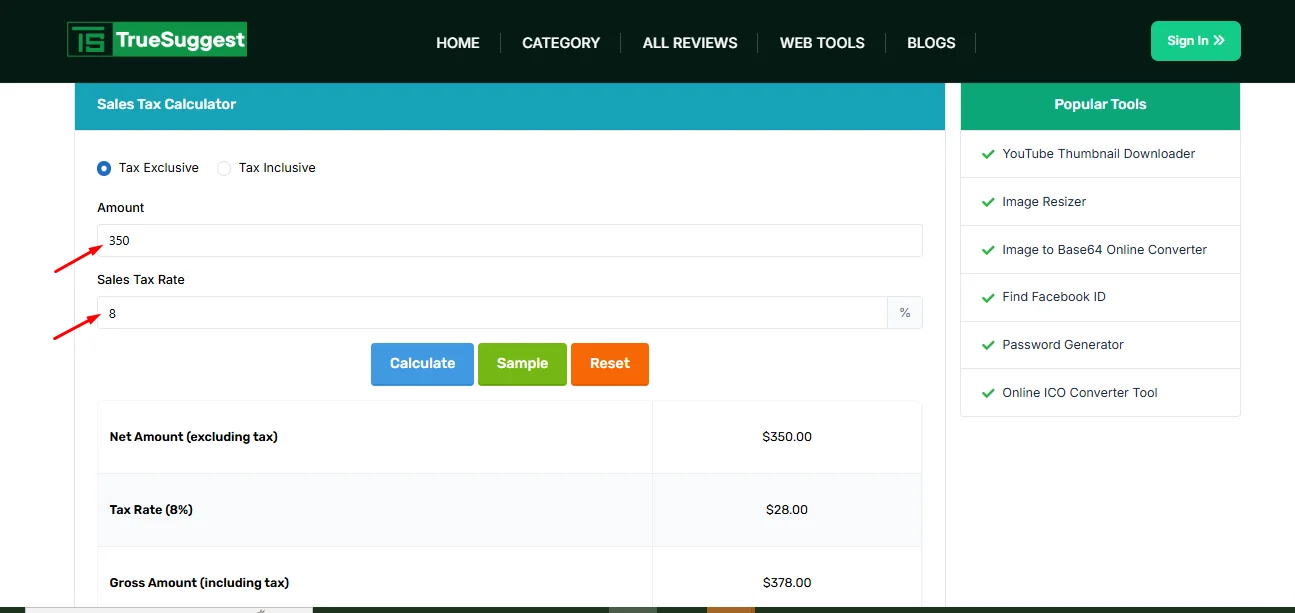

Step2: Now, you have to put your two input values according to what you want to calculate. In that case, you have to input the list amount value and put the sales tax ratio percentage. Here i have applied the list amount $350 and sales tax rate 8%

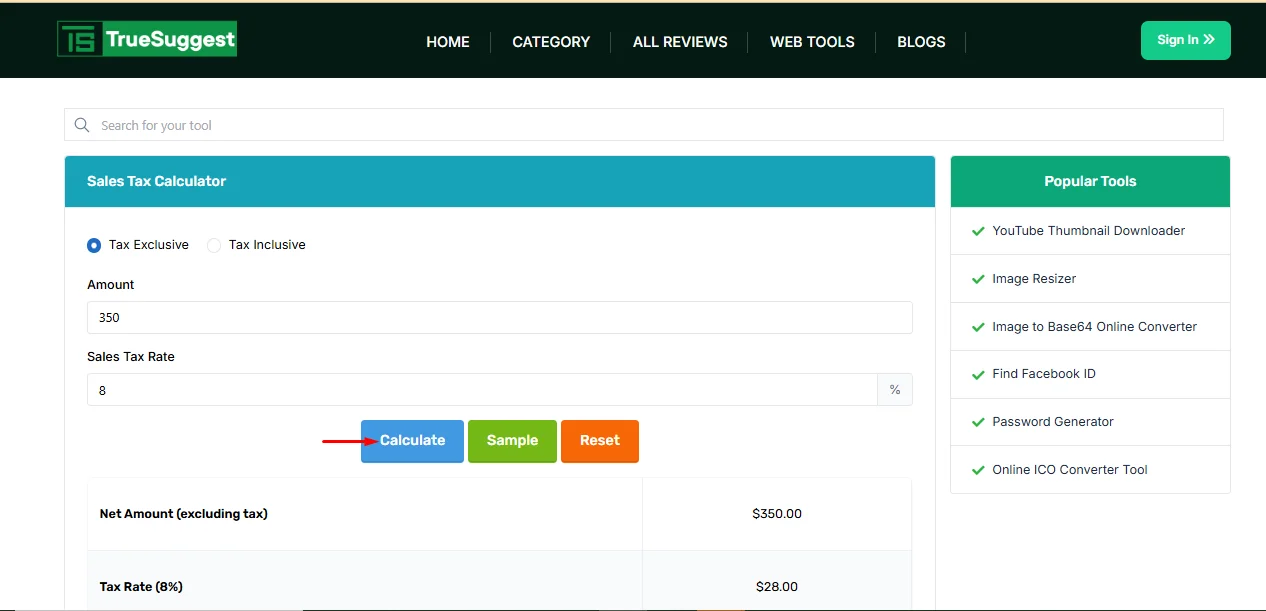

Step3: Now, click on the calculate button.

Step4: Once the calculation is done, you can view the results. Users can also see the sample to understand the process. However, users can also easily reset the value and do new calculations.

.png)