Loan Calculator

What is a Loan?

When someone borrows something, especially money and he says that he will pay it back, then it is called a loan. Loan can be of many things. Loan can be on house building, getting a vehicle, can also be on getting a new phone.

What is a Loan Calculator?

Loan calculator is a type of calculator that can calculate loans of any kind with high precision results. As there are many types of loans, loan calculators can calculate every kind of loan.

To calculate a loan, one needs to provide 3 minimum things; loan amount, loan terms in months and interest rate per year. Loan and loan calculators work with the same mechanism, so whatever the loan type is, it doesn't matter.

How Does Our Loan Calculator Work?

The backend works with the simple javascript function as like our other web tools. It has a function set in it that wherever someone enters the values, it will take them and put them in a mathematical equation.

For example, if the loan amount is $10,000 at an annual interest of 5% which is for a 12 months term. Then the calculation will be:

PMT = P×{r(1+r)^n/(1+r)^n-1

Here, PMT = Monthly payment, P = Loan principal, r = interest rate, n = total number of payments.

So, after putting the values in the equation:

PMT = 10,000×{0.004167(1+0.004167)^12/(1+0.004167)^12-1

The answer comes approximately $856.07.

So our calculator also uses this equation in the backend. This is done by javascript.

How to Calculate Loans With Our Loan Calculator?

It is very easy to calculate loans online with our loan calculator. To calculate, you need to follow some steps. They are:

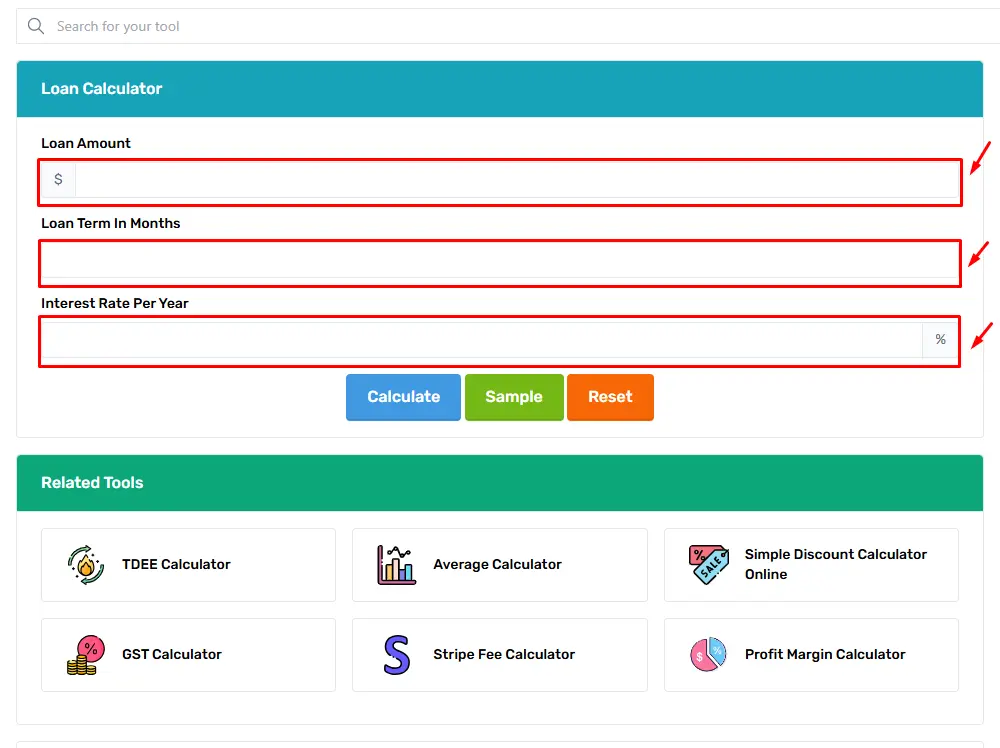

1. After coming to the page, you will see three entry boxes. “Loan Amount”, “Loan Term In Months”, “Interest Rate Per Year”.

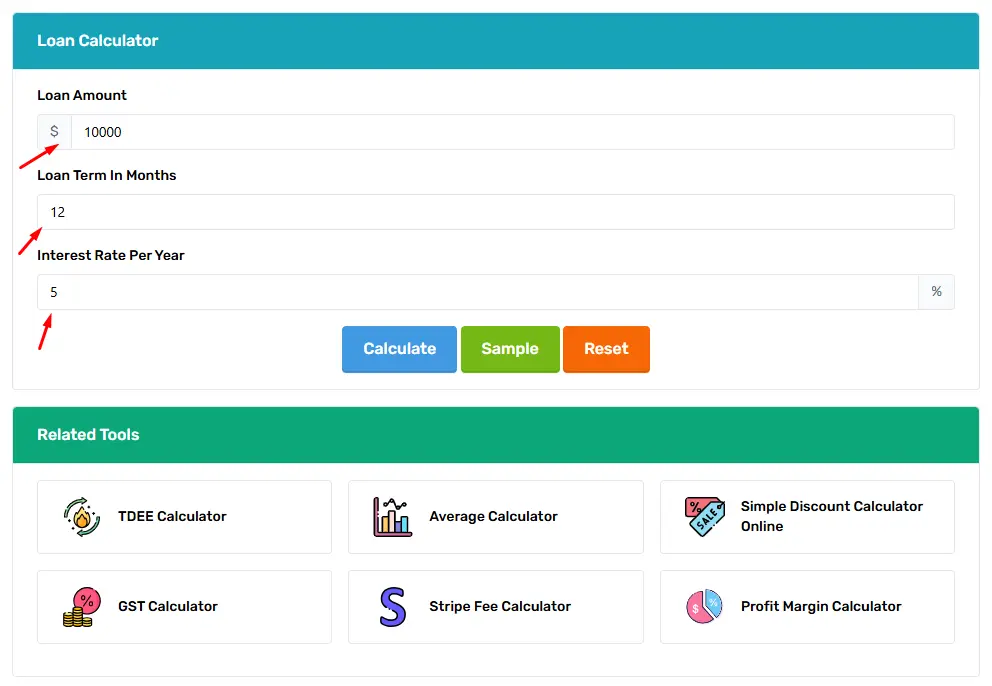

2. Enter your amount in the first box; then loan terms in months, meaning how many months are you given to pay back the amount and third box is the interest rate.

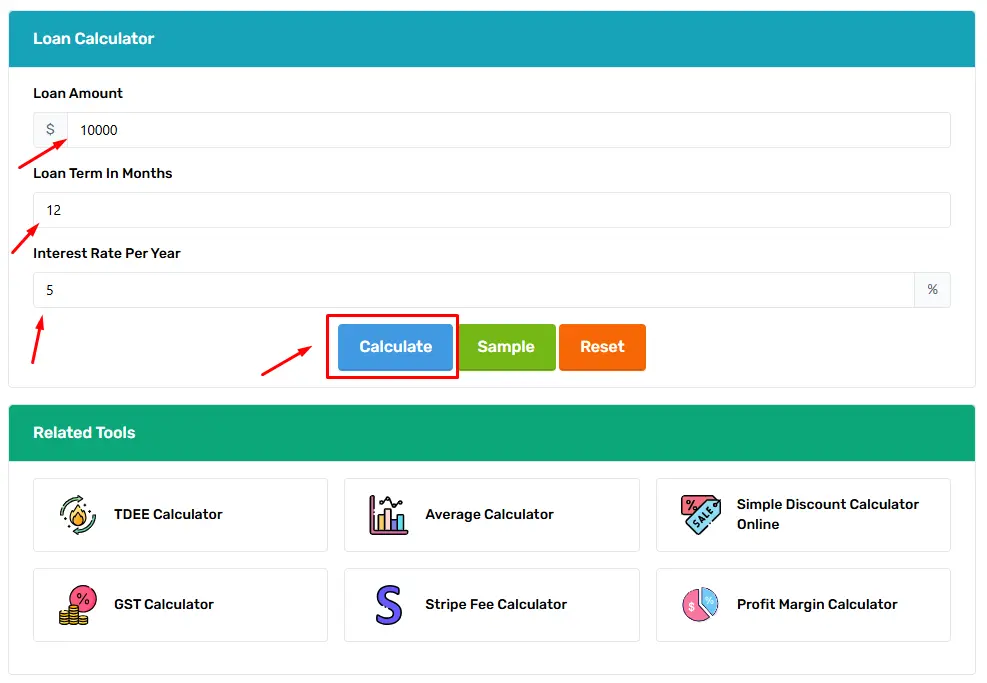

3. After entering all the data, you need to click “Calculate”.

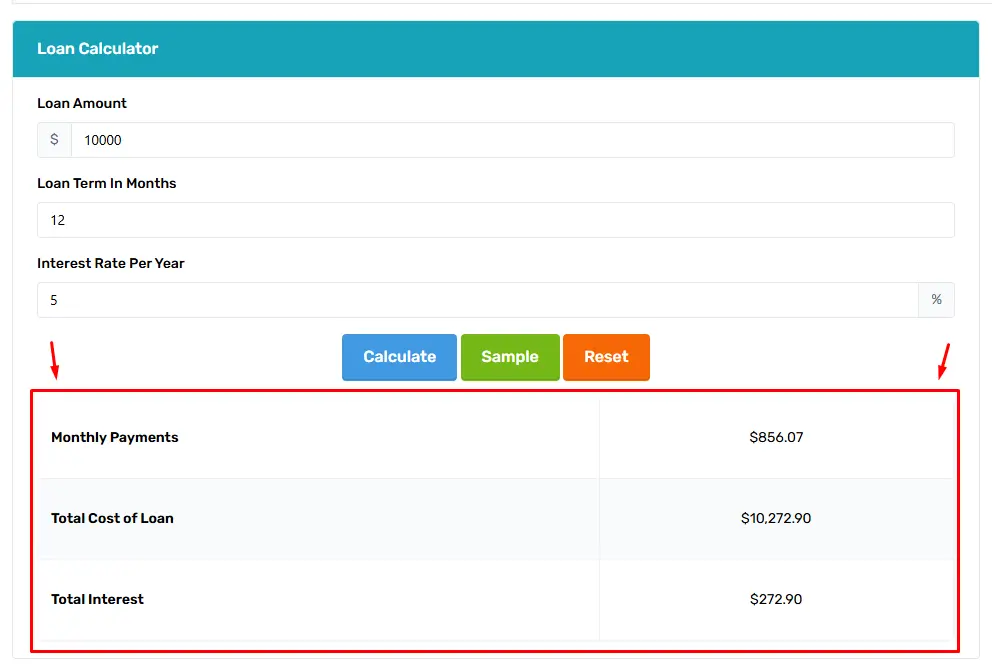

4. You will see result like this:

Why Choose Our Calculator?

Our calculator is different from others. First of all, if anyone wants to see how to calculate the loan, they can use the tools “Sample” button. This will generate some sample data for the 3 boxes. You can then see how it works.

Another great feature it has is, it shows your calculation in three ways. It shows what will be your “Monthly Payments”, your “Total cost of Loan” and also your “Total Interest”. This is the standout feature of the web tool.

Different Types of Loans

There are different types of loans as different people need different types of loans. These loans are:

Personal Loans

Personal loans are loans that do not have any collateral security. It usually has repayment terms between 24 to 84 months.

Auto Loans

As the name suggests, auto loans mean getting a loan for buying a vehicle. Its repayment term is 3 to 7 years. The collateral of this kind of loan is the vehicle itself meaning if you cannot pay in time, your car will be repossessed by the lender.

Home Equity Loan

Home equity loan, also known as second mortgage. If you have equity in your home, you can then apply for this loan.

Student Loans

Student loans are for their tuition fees, living expenses at the designated schools. Meaning, you cannot use that loan for personal use or other use that doesn't go with the loan terms.

Payday Loans

Payday loans are not credit based as they are a short-term loan. It usually lasts just until your next paycheck.

Unsecured Loans

Unsecured loans don't need any collateral. It is backed by your signature only. So it is also called signature loans. However, as this is an expensive loan, it has more risk. So it requires better credit.

Small Business Loans

Small business loans are for small businesses to fund their operations. This type of loan requires more qualification than personal loans as it is a high worth loan and gives your business a boost.

Secured Loans

Secured loans are secured because it is backed by collaterals like a house, vehicle or savings account. If you cannot pay the loan then your backed up assets will work as your loan payment.

Debt Consolidation Loans

This type of loan helps you pay off your other debts. This type of loan is best for those who are facing high credit loans or high personal loans.

Construction Loans

You need a loan to build a house and your regular mortgage cannot finance it, because you don't have anything yet to mortgage it. So in this case you can take a construction loan. After the construction it can convert into an actual mortgage.

Gold Loan

Gold loan is a short-term loan. It requires you to assure some gold jewellery or coins as collateral. It is one of the growing businesses, over 67.40 Bn in 2024 and will increase 12.30% this year in India.

Fixed Rate Loans

One of the easiest loans in the list. This is a fixed interest based loan which does not fluctuate with the market. Sp it becomes easier for the debt person to accurately predict the future payments.

Loan Against Property

This type of loan is one of the most common loans all over the world. It offers any type of amount when you mortgage something like your property, residential or commercial. However, the amount of loan depends on the mortgage size and type.

Flexi Loans

Flexi loans give you the freedom of withdrawing money from your approved limits in any amount, at any time. The best part is you have to only pay interest only on the amount you have utilised.

Jumbo Loan

Jumbo loan is that loan which is given to people living in high-cost areas. In 2025, this amount is more than $806,500, or $1,209,750 for those places. As this type of loan has high risk, it is not given to everybody.

However, there are other loans. They can be term loans which give you different terms for giving you a loan. Term loans can be short-term or long-term. There is also a loan against fixed deposits.

Loan Basics for Borrowers to Know

Before taking any loans there are things to know. The first thing is the interest rate. It means if you borrow any sum of money from someone, they will charge you a percentage for lending it to you. That is interest and the rate depends on the deals. Usually this is paid annually or monthly.

Then comes compounding frequency which means how often your interest will be added. The more it compounds the more you have to pay.

Then there is the loan term. It means in how many months or years, you will pay the money. The higher the month,,the lower the amount you have to pay every month but the catch is you have to pay more interest.

What are the Benefits of Using a Loan Calculator?

Using the loan calculator will not only save time but also give you an errorless calculated result. So you don’t have to double check it.

What is APR?

In terms of loan, APR stands for Annual Percentage Rate. Simply it means total cost of borrowing over the year. It includes other subsidiary fees like interest rate and other fees. Basically it helps you to calculate the true cost of borrowing with all other fees.

How Can I Get a Personal Loan?

There are some prerequisites or criteria you need to fulfil before getting approved for a personal loan. You need a permanent job, be at least 25, and have a minimum income of 25,000. Then you can apply for loans in banks near you. Contact your nearest bank and apply for a loan.

.png)